Present value of lease payments formula

The yield to maturity YTM refers to the rate of interest used to discount future cash. Where is the number of terms and is the per period interest rate.

Compute The Present Value Of Minimum Future Lease Payments Youtube

The net investment in the lease is presented as a receivable on the statement of net position.

. It includes the value of all cash flows regardless of duration and is an. Assume that you lease a warehouse to another business and the lessee agrees to pay you 4000 a year for 6 years. The lessor recognizes any.

Replace the parameters in the future value formula F P 1 r t. Since the up-front cash payment is less than the present value of the 36 monthly lease payments ABC should pay cash for the machinery. The commercial lease agreement is a notorious real estate form frequently carried out by those who would like to rent space to use for their business interestIt allows the owner of the property and the party interested in buying to record how the tenancy will transpire.

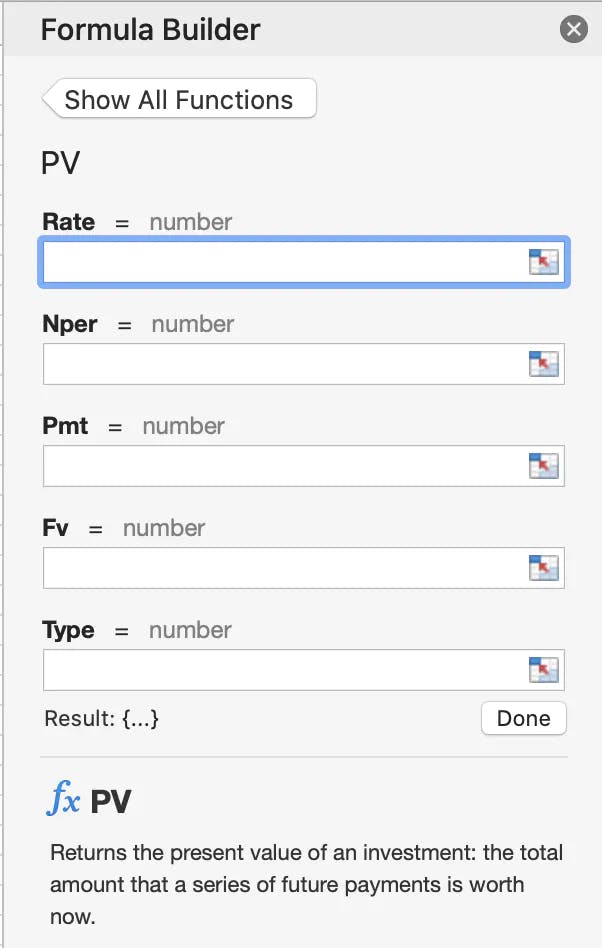

Disadvantages of the Present Value of an Ordinary Annuity Formula. Find the present value formula for a single sum 10000 for 3 years at 5. The ClearTax Lease Calculator uses the residual value of the asset to calculate both the monthly lease payments and the total.

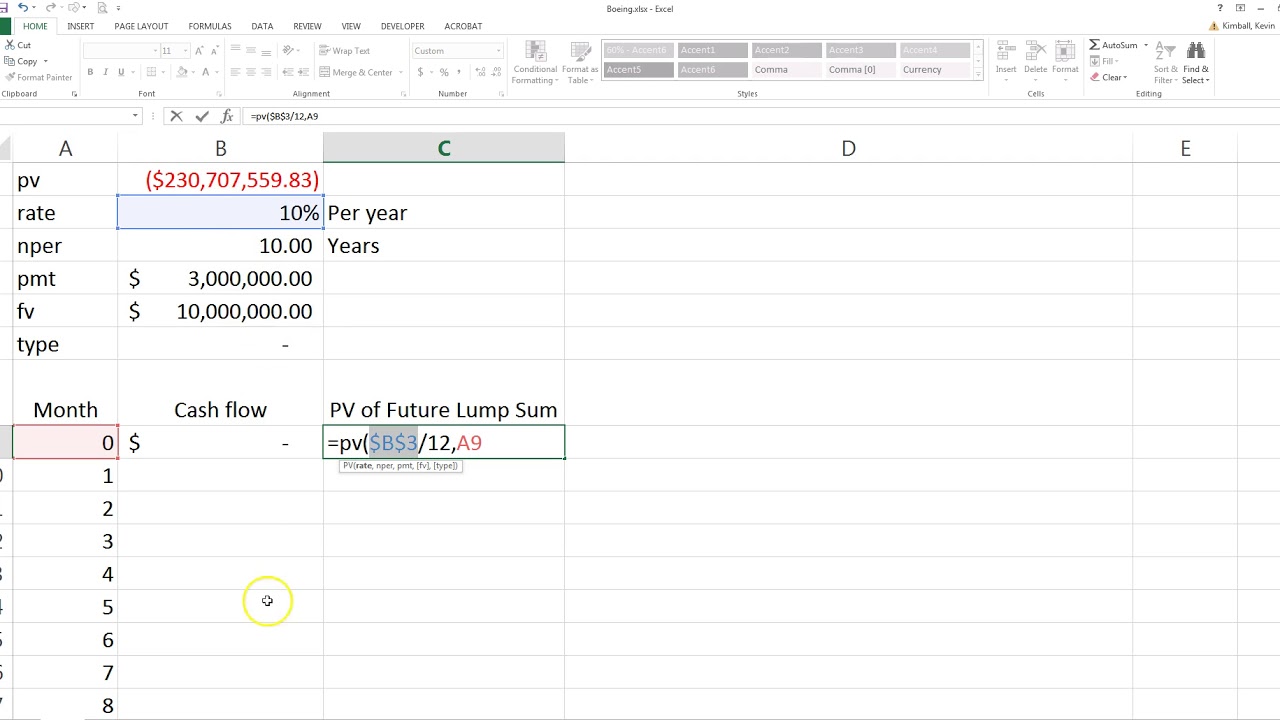

The formula for calculating PV in Excel. Have questions or need assistance. The total amount that all future payments are worth now.

If you make monthly payments on the same loan then multiply the number of years by 12 and use 512 or 60 for nper. Our Customer Service team is available weekdays from 8 am. Present value commonly referred to as PV is the calculation of what a future sum of money or stream of cash flows is worth today given a specified rate of return over a specified period of time.

Present value is linear in the amount of payments therefore the. This figure is not extracted from the lease agreement. The lease payments and the unguaranteed residual value to equal the sum of.

By rearranging the formula we can calculate how much each payment must be worth in order to equal a present value where the present value is the value of the loan. For example you could use this formula to calculate the present value of your future rent payments as specified in your lease. While this formula can be quite useful it can yield misleading results if actual interest rates vary during the analysis period.

The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future. The present value is given in actuarial notation by. Lets say you pay 1000 a month in rent.

The present value of the guaranteed amount of the underlying assets residual value at the end of the lease term. Set how long in the future t you wish to calculate future value for. Significant details relative to the sale will include the length of time the tenant will have the right to occupy the.

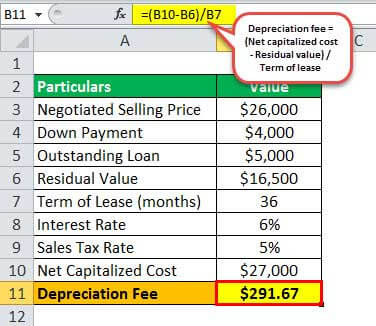

Under the new lease accounting standards lessees are required to calculate the present value of any future lease payments to. Present value PV is the current value of an expected future stream of cash flow. Below we can see what the.

What is Modified Duration. The lease calculator helps you compute the monthly and total payments for a lease. Pv required - the present value ie.

From inputting the above into the XNPV formula it results in the present value calculation of 11637. Present value of an annuity. Modified Duration tells the investor how much the price of the bond Price Of The Bond The bond pricing formula calculates the present value of the probable future cash flows which include coupon payments and the par value which is the redemption amount at maturity.

The lessor uses the residual value to determine the periodic lease payments the lessee must make on the asset. Within IFRS 16 Appendix A the Glossary specifically defines the interest rate implicit in the lease as the rate of interest that causes the present value of. Write down the present value P.

The discount rate is the input used to calculate the present value of the known future lease payments. Present value can be calculated relatively quickly using Microsoft Excel. Present value of lease payments explained.

The present value of lease payments not yet received. In case of a loan its simply the original amount. The present value of an annuity formula equates how much a stream of equal payments made at regular intervals is worth at current time.

For example if you make annual payments on a 5-year loan supply 5 for nper. This is the lease liability balance at the commencement of the lease. Recognize profit or loss.

In addition annuity tables allow you to calculate the value of a stream of payments. The present value of the unguaranteed amount of the underlying assets residual value at the end of the lease term. Bond price is calculated as the present value of the cash flow generated by the bond namely the coupon payment throughout the life of the bond and the principal payment or the balloon payment at the end of the bonds lifeYou can see how it changes over time in the bond price chart in our calculator.

ET and from 9 am. 1 Projections of the Financial Statements 2 Calculating the Free Cash Flow to Firms 3 Calculating the Discount Rate 4 Calculating the Terminal Value Calculating The Terminal Value The terminal value formula helps in estimating the value of a business beyond the explicit forecast period. Just give us a call at 18002053464.

To use bond price equation you need to input the following.

How To Calculate The Present Value Of Future Lease Payments

Lease Payment Formula Example Calculate Monthly Lease Payment

How To Calculate The Present Value Of Lease Payments In Excel

Now Download Bookkeeping Templates Excel Free Workbook Format For Your Project Business Management Bus Bookkeeping Templates Bookkeeping Financial Management

How To Calculate The Present Value Of Future Lease Payments

Compute The Present Value Of Minimum Future Lease Payments Youtube

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Present Value Of Lease Payments Excel Occupier

Lease Payment Formula Example Calculate Monthly Lease Payment

Free Printable Land Contract Forms Word File Real Estate Forms Real Estate Contract Things To Sell

How To Calculate The Present Value Of Future Lease Payments

How To Calculate A Lease Payment Double Entry Bookkeeping

How To Calculate The Present Value Of Lease Payments Excel Occupier

How To Calculate Lease Payments Youtube

How To Calculate The Present Value Of Lease Payments Excel Occupier

How To Calculate The Present Value Of Lease Payments In Excel

Depreciation Loan Amortization Schedules Depreciation Etsy Canada In 2022 Amortization Schedule Company Financials Financial Business Plan